Rio Grande

Overview

|

Geology |

Cu-Au porphyry prospect with associated IOCG style alteration |

|

Location |

High Puna of NW Argentina, 450 km west of the city of Salta |

|

Nearby Projects |

Lindero Au porphry mine (Fortuna Silver) 10 km west |

|

Discovered |

1999 by Mansfield Minerals |

|

Elevation |

Between 3,700 m and 4,700 m |

|

Drilling to Date |

74,210 m. |

|

Ownership |

100% Aldebaran Resources |

Rio Grande is a large porphyry copper-gold prospect with associated IOCG (iron-oxide-copper-gold) style alteration located in Salta Province, northwestern Argentina. Copper-gold mineralization at Rio Grande occurs within the eroded central core of a mid-Miocene intrusive center and is best expressed by a large area (2 km by 2 km) of well-defined, coincident copper-in-soil, gold-in-soil, and induced polarization (IP) chargeability anomalies. Trenching and drilling programs by Teck Corporation (2000-2001), Antares (2004-2008) and Regulus (2010-2012) have partially delineated the Discovery and Sofia copper-gold zones along the southeast margins of the system, extended the known mineralization to the northern and western margins of the system, and also encountered indications of deeper copper-gold mineralization beneath the central portion of the system.

Resource

Resource 2018

Mineral Resource estimate prepared by RPA for the Rio Grande Project as of August 17, 2018 is summarized below:

| Class/ Oxidation |

Tonnes (Mt) |

Cu (%) |

Au (g/t) |

Ag (g/t) |

Cu (Mlb) |

Au (Koz) |

Ag (Moz) |

|---|---|---|---|---|---|---|---|

| Indicated Total | 71.0 | 0.30 | 0.36 | 3.2 | 468.6 | 815 | 7.3 |

| Inferred Total | 41.0 | 0.23 | 0.28 | 2.8 | 208.4 | 375 | 3.6 |

Notes

- CIM (2014) definitions were followed for Mineral Resources.

- Mineral Resources are reported within a preliminary open pit resource shell.

- Mineral Resources are estimated at a net smelter return (NSR) cut-off grade of US$8.00/t for oxide, US$12.00/t for transition and US$7.50/t for sulphide. No sulphide material was captured in resource shell.

- Mineral Resources are estimated using a long-term gold price of US$1,400 per ounce, copper price of US$3.50 per pound.

- Bulk density is 2.41 t/m3 oxide 2.50 t/m3 oxide and 2.62 t/m3 sulphide.

- Numbers may not add due to rounding.

Please click here to view the Rio Grande Technical Report 2018

Location

The Rio Grande project is very favourably located along the prominent northwest-trending Archibarca Lineament which also controls the location of the world-class giant Escondida porphyry copper deposit 150 km to the northwest in Chile. The Rio Grande project shares geologic similarities with the Bajo de Alumbrera porphyry copper-gold deposit which is located along a similar northwest-trending regional structural lineament approximately 300 km to the south.

Access and Infrastructure

Access to the project from Salta, which is the principal economic center of the region, is by paved roads for 100 km and by all-weather dirt roads for 350 km along National Highway 51 and Provincial Highway 27, which extend from Salta to the Chilean border. Total travel time is approximately 8 hours. The access route is from Salta to San Antonio de Los Cobres on National Highway 51 (140 km), continuing to the small town of Tolar Grande on Provincial Highway 27 (210 km) and then traveling along an undesignated route to Regulus' Rio Grande camp at Mina Arita (80 km).

The Rio Grande property occurs in the Altiplano of NW Argentina at elevations between 3,700 m and 4,700 m. Base levels of the salars in the area are approximately 3,700 m, with surrounding volcanic peaks to over 6,000 m. The nearest town with services is Tolar Grande located on Provincial Highway 27, 1.5 hours by road northeast of the Regulus Rio Grande camp.

The project has the following nearby infrastructure:

- A narrow-gauge railway extending to Antofagasta on the Chilean coast is located 100 km to the north.

- A high-tension power line extending between Salta and Chuquicamata Mine in Chile is located 120 km to the north.

- The Jujuy Hombre Muerto gas pipeline is located 100 km to the east.

Geology and Mineralization

The western part of Salta Province is underlain by mid to late Tertiary continental volcanic arcs and related sedimentary rocks of the Andean cycle. The Andean volanic arcs are concentrated along the north trending axis of the high Andes and along several northwest trending “structural transverse zones”. The Rio Grande area consists of two overlapping andesitic volcanic centres, as well as numerous flanking shallow intrusive plugs, dikes, and sills. Both are constructed of dacitic to andesitic flows, sills and dikes, intruding and flanked by volcaniclastic rocks, including breccias, agglomerates, and lahars, generally dipping away from the volcanic centres. Alteration is roughly concentrically zoned and is strongly influenced by rock type. The occurrence of veining and mineralization at Rio Grande is associated with the development of several distinctive hypogene events during the evolution of the deposit. In addition, supergene types of mineralization at Rio Grande were developed during the uplift and erosion of the deposit in younger stages and up to the present-day time.

The Rio Grande deposit has been the subject of much debate concerning the origin of the mineralization and deposit type. Different styles of copper-gold mineralization with associated alteration have been recognized. There is an early mineralized system with affinities to IOCG (iron-oxide-copper-gold) type deposits, and a later mineralized system with affinities to porphyry style copper-gold deposits.

The Rio Grande property is a large porphyry Cu-Au prospect with alkaline porphyry affinities. Mineralization covers a large area measuring at least 4 sq. km. and consists of disseminated and veinlet-controlled magnetite-chalcopyrite. Primary copper sulphides have been weathered to secondary, black and blue-green copper oxides to depths in excess of 200 m. A thorough review of work previously completed by Teck in 2000-2001, as well as new geological and structural mapping by Regulus, has identified a series of target areas with potential for higher copper-gold grades within a distinct 2 km diameter ring of IP chargeability and anomalous surface and subsurface copper and gold geochemistry. The 200 m average estimated depth to the top of the IP anomalies together with drill hole information suggest that there is potential for an extensive area of oxidized mineralization that may be amenable to SX-EW recovery of copper.

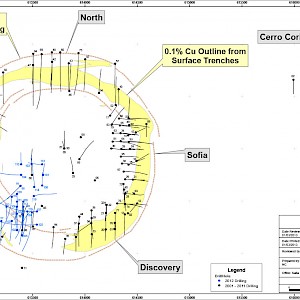

Cu-Au-Ag mineralization at Rio Grande occurs within a distinct 2-km diameter ring-shaped fracture zone defined by IP chargeability, as well as Cu- and Au-soil geochemical anomalies. Systematic surface trenching shows the majority of the ring structure is mineralized in several zones/targets; moving clockwise from the north these zones are (a) North, (b) Sofia, (c) Discovery, (d) Southwest, and (e) #7. Trenching and drilling in the central part also shows presence of mineralization.

Rio Grande is located within a partially eroded, earliest Middle Miocene (16.5 Ma), andesite-dominated volcanic-intrusive complex of high-K, alkaline affinity. The Rio Grande complex intrudes through granitic basement rocks into a continental back-arc basin filled with a thick (>1,500 m), oxidized sequence of continental red bed sandstones. Sections within this sequence contain sulphate evaporites and possible halite in the upper parts of the section. Host rocks include a wide variety of dacite to andesite, sub-volcanic, hypabyssal intrusive rocks and dykes.

The Rio Grande complex is located along the regional ESE-trending Archibarca lineament; where it is intersected by NNE-trending “East Fissure” parallel structures. The faults vary from large, property-extensive structures to narrow, outcrop-specific structures. The character of the faults measured is quite variable, ranging from single, narrow fault surfaces to complex fault/fracture zones exhibiting gouge and broken rock. Structural mapping indicates there are two principal orientations of faults; a prominent ESE-trending set (“Archibarca Transverse Zone”) and lesser prominent NE-trending set (“East Fissure Fault Zone”), which together define the rhomb-shaped, annular (i.e. ring-like) geometry of the mineralization. The mineralized zones are steeply, inward-dipping (i.e., towards the centre of the Rio Grande complex).

The alteration developed in rocks from Rio Grande project is the result of extensive hydrothermal activity. Five main alteration types have been identified, including:

- Potassic K-feldspar (PK),

- Calcic-Iron-Sodic (CaFeNa), (commonly diopside ± magnetite ± K-feldspar ± scapolite ± actinolite)

- Potassic Biotite (PB),

- Chloritic / Propylitic (CHL/PRO),

- Iron Oxide / Clay (FeOx / CLAY).

Zonation of the alteration is roughly concentric, with a strong to intensely altered central core area, where mainly intrusive subvolcanic rocks are located, grading outward to less altered rocks in the surrounding areas. Rocks in the outlying areas are dominated by intermediate volcanoclastic rocks and red bed sedimentary rocks which often exhibit clay and/or chloritic or weak propylitic alteration.

Near the core of the Rio Grande system, the rocks exhibit variable degrees of potassic, K-feldspar alteration. The innermost zone of the main igneous centre contains broad zones of moderate to intense calcic-iron-sodic (CaFeNa) alteration that commonly consists of variable amounts of diopside, magnetite, actinolite and scapolite. Also limited areas of potassic biotite altered rocks are more developed in the central area of the Rio Grande system.

Mineralization covers a large area measuring at least 4 sq. km. Four distinct mineralization styles have been identified at the Rio Grande property:

- Near surface, fracture-controlled copper oxides ±sulphides (at depth) with gold

- Structurally controlled copper-gold style mineralization with magnetite-chalcopyrite-pyrite-magnetite, possibly related to deeper porphyry copper-gold style mineralization

- Copper-gold style mineralization with chalcopyrite-pyrite-molybdenite associated with anhydrite veinlets, likely related to deeper porphyry copper-gold style mineralization

- Gold-copper mineralization associated with quartz-magnetite stockworks in diorite intrusive rocks similar to the nearby Lindero deposit.

Within the upper oxidized and mixed ore zones, the main copper-gold mineralization at Rio Grande occurs as fracture-controlled copper oxides and sulphides, which form an annular ring around the main zone of alteration. Mineralization occurs as blue-green and black copper oxides in the near surface environment (i.e., upper ~100-150 m) and mixed oxides and sulphides in the deeper environment (i.e., below ~150 m); both with associated gold.

The principal copper oxide minerals are chrysocolla, malachite, and traces of azurite. The principal sulphide minerals are chalcopyrite and pyrite, which are typically associated with magnetite. Chalcopyrite (with gold) occurs as coarse-grained clots, disseminations, stringers, and fracture-fillings. In the near surface environment the chalcopyrite is commonly oxidized to a dark brown coloured, translucent “copper limonite”, as well as chrysocolla and other blue-green and black oxides (i.e., Cu-bearing Mn-oxides and neoticite). Mineralization of minor quartz-magnetite sheeted veinlets which contain gold and little copper occurs in a satellite target named Cerro Cori, located approx. 2 km northeast from the main Rio Grande mineralized area. In addition to the mineralization described above, there are more classic, quartz-pyrite-magnetite veins and stockworks associated with K-feldspar alteration; which occur in the southwest area.

Exploration History and Drilling

1999: Mansfield Minerals Inc. prospected the Rio Grande area collecting 210 surface rock samples which defined and delineated a zone of Cu-Au mineralization. A simplified sketch alteration map was generated showing the different alteration types and exploration targets in the 2 x 2 km area.

2000: Mansfield signed a joint venture agreement with Teck and the latter had the opportunity to earn a 55% interest and was the manager of the exploration project. In the following months Teck completed geological mapping at different scales and additional surface rock samples were collected which defined new mineralized zones. An orientation soil survey was completed, some hand trenches were dug and channel samples collected along their length; these assays returned encouraging results.

2001: Quantec Geoscience Argentina conducted ground magnetic and Induced Polarization (IP) geophysical surveys. A trenching program was undertaken in order to test the Cu-Au anomalies generated by the soil sampling and prospecting programs. A diamond drilling program consisting of 11 holes, totalling 3,220.6 m was completed. Additional work on the property was recommended; however, Teck terminated its exploration efforts in Argentina in early 2002, and returned the property to Mansfield.

2004-2005: In June 2004, Mansfield and Planet Ventures Inc. (predecessor of Antares) signed a joint venture agreement in which Antares became the operator of exploration on the property. Antares began actively exploring the property in October 2004 and completed the first phase of this work in May 2005.

2005-2008: Antares completed a gradient array ground IP survey, extensive surface trenching and sampling, an enhanced topographic survey, and numerous additional drill holes.

2009: The global economic crisis forced Antares to put the Rio Grande project on hold while it focused on its Haquira Cu-Mo-Au project in Peru.

2010: Antares was officially sold to First Quantum for C$650 MM. At the same time, Antares then spun out the Rio Grande project along with C$5 MM in cash into a new company called Regulus Resources Inc.

2011: Regulus completed an aggressive exploration program which included a Quantec Titan 24 geophysical survey (IP. DC and MT), 15,025 m of drilling in 20 diamond drill holes, the first metallurgical work on the property and the first 43-101 complaint resource on the Rio Grande project. Regulus announces the discovery of a new high-grade Au-Cu mineralized zone in the Southwest zone.

2012: Regulus and its JV partner company Pachamama Resources Inc. consolidated the Rio Grande project ownership through a plan arrangement which merged the two companies (retaining the name "Regulus"). The merged company raised C$27 MM and conducted a 24,970 m, 28 drill hole program which focused primarily on a new high-grade discovery in the southwest zone. Regulus also completed a single drill hole on the edge of a large Au soil anomaly in the Cerro Cori area, which is located 2 km east of Rio Grande.

2013-2014: Regulus conducts a follow-up 1,200 m, 4 drill hole campaign at Cerro Cori. During the second half of 2013, an extensive core re-logging campaign was initiated at Rio Grande, which included detailed geological descriptions for all 74,210 m drilled, extensive petrographic-staining work, integration of all geophysical information, development of an updated geological model, and definition of new drill targets.

2014 to 2018: Activities at Rio Grande were suspended from 2014 as Regulus focused on the AntaKori Cu-Au project in Peru. In 2018 the Rio Grande project was one of the assets spun out from Regulus into the new Argentina-focussed company Aldebaran.

2019-Present: No material work was performed on the Rio Grande project since the beginning of the year commencing July 1, 2020. The Rio Grande project is under review to evaluate potential synergies with the nearby Lindero Mine where Fortuna Silver entered into commercial production in Q1-2021.

Drilling

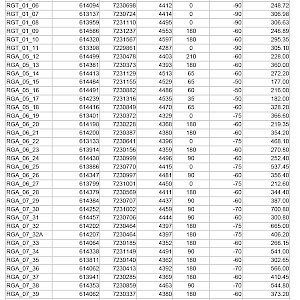

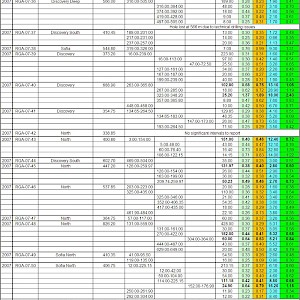

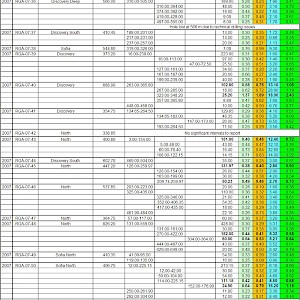

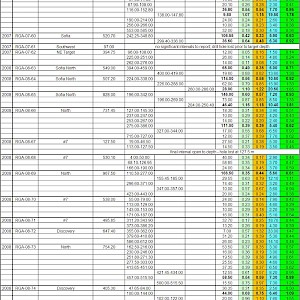

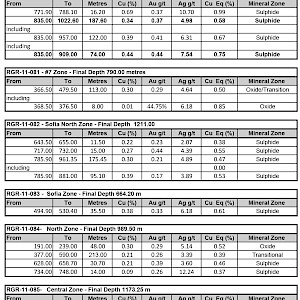

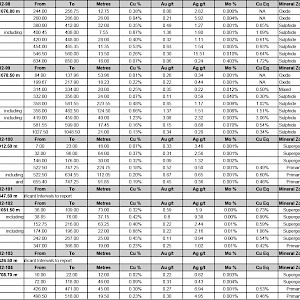

From 2001 to 2012 a total of 74,210 metres of drilling in 130 drill holes was completed at the Rio Grande project. The location and collar information of each hole is presented in Table 1 and Figure 1. All of the significant drill hole intercepts (using a 0.2% CuT cut-off) are reported in Table 2a to 2e. A short drilling program was completed at the nearby Cerro Cori target in 2013-14 (1,200 m in 4 holes). Results from those drill programs have previously been released by Regulus.

Regulus suspended drilling activity at the Rio Grande Project in late 2012 to conserve cash and re-evaluate the exploration strategy in light of challenging market conditions. During 2015 and early 2016, a major project data review was completed including re-logging of all drill core from the project. After completion of this data review, management believes that further exploration at depth is merited. The June 2016 acquisition of Goldrock Mines Corp. and its Lindero gold project by Fortuna Silver Mines Inc. may have an impact on future exploration and possible development at the Rio Grande Project. The Lindero gold project is located approximately 10 km from the Rio Grande project and Fortuna Silver has announced it is in production.